Moving Forward, One Step At A Time

Greetings, wine country friends. I hope you are enjoying spring and making the most of these strange times. Clearly, we are enduring an unprecedented challenge with Covid-19 health issues and associated economic impact. As a community I am sure we will ultimately arrive at a destination that resembles the wine country that we all know and love. Let’s take a look at Sonoma and Napa real estate 2020.

Until then, we have to work through what is directly in front of us. On the good news front, wine sales are up, way up. Mostly for lower priced wine but it is still helping put a dent in some of the surplus we have encountered in the last couple of years. Additionally, there are a few great deals on higher quality wine if you know where to find them. A helpful assist in these challenging times

Sonoma Pinot Noir Vineyard & Estate Building Site

Green Acres Is The Place To Be

Interest in “country” property / wine country property has seen an uptick lately. One could call it the Corona effect but I prefer to call it “Green Acres”. After years of society moving to more clustered, high density living spaces in cities, some are reassessing whether they need more space. Locally, in the Bay Area, that means people are considering wine country more than they did just six months ago. Will that translate into a definitive trend or just a blip? We do not know for sure, but it is something to keep an eye on.

For Vintroux Real Estate it has been an interesting year. Numerous small winery and vineyard transactions have kept me busy. Since the lockdown I have been doing what real estate related work can be done, as well as built a fence, planted numerous plants, did a ton of tree work, cooked a lot, drank a bit, read a couple books… tried to avoid social media nonsense, so on and so forth. But now as we are start to get things moving again, it is time to reactivate the market. Let’s take a look at the market now.

Wine Country Real Estate / Vineyard Values

An obvious question is how the Covid-19 situation impacts real estate. In wine country this question is combined with the current oversupply of wine grapes. Together, how do these two factors impact value?

First, the same time tested rule applies: Blue Chip properties will fare better than average or below average properties. This means that the super premium properties and vineyards of the Napa Valley and Sonoma County will likely see little change in their value. The grapes are still coveted, the locations are desired and those with resources will continue to make decisions that suit their interests. Second, average properties that maintain contracts will likely have some softening but not necessarily a precipitous drop in value. Finally, properties and vineyards that do not have contracts will have a tougher time justifying the status quo… unless there is a strong lifestyle component.

Vineyard values in Napa Valley can range anywhere from $150,000 /acre to $500,000++ / acre. In Sonoma County the values range from $75,000 / acre to $200,000 / acre.

Wine Grape Prices

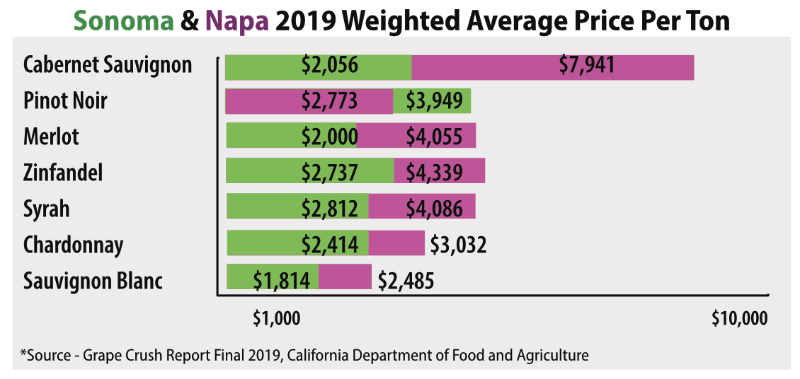

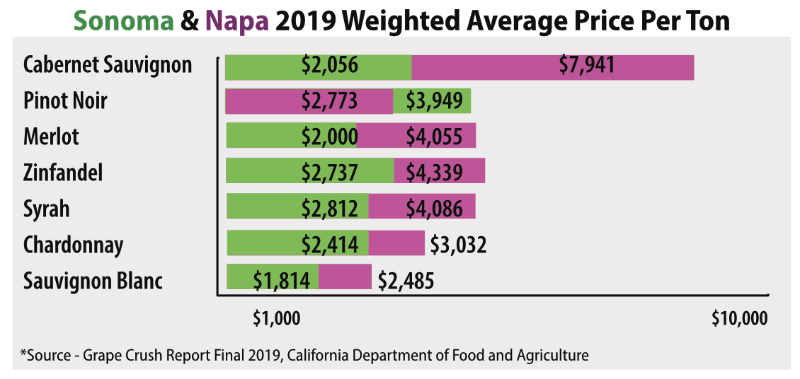

Wine grape prices have a direct impact on vineyards. As we all know, we are more than a year into the oversupply of the grape cycle. This is a chart of current average grape prices in Napa and Sonoma Counties.

2019 Sonoma & Napa Wine Grape Prices

Click Here to See a Chart Comparing Wine Grape Sales For the Last Several Years

The Full Grape Crush Report Can Be Found Here

It is important to keep in mind that this information only relates to grapes sold under contract. This does not reflect vineyards that had to drop their fruit, sell on the spot market or did not sell at all. In other words, this chart does not reflect the true wine grape market but it is helpful.

Another popular question: What is my winery worth?

During these challenging times many are curious about the value of their winery. Well, I can tell you that having sold multiple wineries in the last year there is interest.

Buyers come to the market with several drivers including passion, business fundamentals and future potential. It is important for Sellers to be realistic with respect to what they are offering. Wineries have many moving parts, so this type of transaction is not for the faint of heart. To get a fact based assessment of market value, it is important to work with professionals who have intimate knowledge and experience in the wine business. This helps avoid surprises and can even improve the business presentation. I have partnered with Triumph Advisors to help Sellers prepare for a sale and Buyers enter the business. They provide a full array of the following advisory services for small to mid-sized wineries up to 200k cases.

Practical and effective expertise in the core competency areas of a winery business: Production, Finance, Sales, Marketing and DTC.

- Business Model, Scale & Performance Evaluations

- Strategic Planning & Development

- Management Services – CEO/CFO/CMO/CSO for hire

So, where does this leave us?

Great question! We still have to work through the oversupply and prices will likely soften in some areas. My experience says that there continues to be activity, transactions will take place and people with resources (lifestyle and wine industry) are going to proceed with decisions that fit their needs. We keep moving forward.

If you would like to discuss your property, we can set up a telephone call, a video conference or even an in person meeting (physical distancing, of course). Things may look a little different right now but that does not mean deals can not get done.

Cheers!

David Ashcraft

Click Here For PDF Version

Next Newsletter

Previous Newsletter

Some additional articles that might be helpful:

What is a vineyard really worth? It depends.

Wine Country Real Estate Building Blocks

Looking to Buy A Winery, Start Here

So where exactly is wine country?

Buying a Vineyard? A short course to the basics.

Which AVA came first?

If you are serious about your wine country search, please contact us today. Last but least, here is link to more local resources.