www.calasfmra.com

California Chapter: American Society of Farm Managers and Rural Appraisers

ARA (Agricultural Rural Appraiser) Contributors:

An Excerpt from the 2012 Trends

– Hal Forcey ARA, Chair

– Michael D Pipkin ARA

– Russ Forsburg ARA

– Mark Gregg ARA

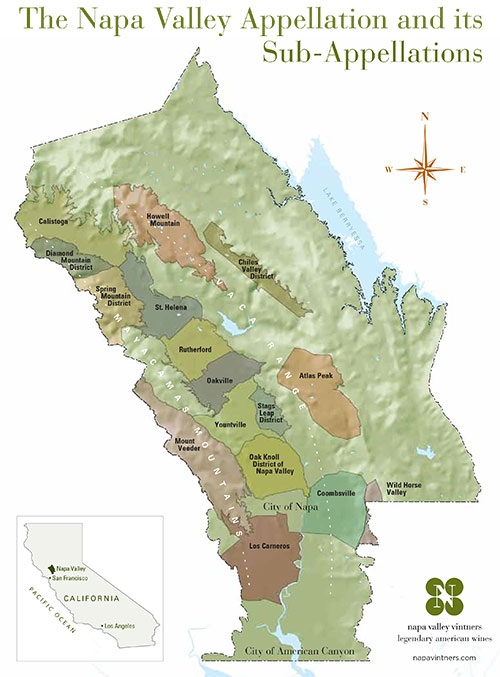

Napa County

While most of the North Coast saw glimmers of improvement, 2011 was something of a banner sales year in Napa County. Sales and values were strong, with a number of vineyard, winery, and estate properties trading hands. These sales were fueled by the presence of local and international investors, plus a marked increase in lifestyle buyers. Napa continues to have the strongest reputation in the state with above average financial stability that allows it to weather economic downturns better than most agricultural markets. The reputation of the region coupled with strong local and international demand for vineyards, wineries, and rural estates is most apparent in troubled economic times, evidenced by the fact that the region has not suffered a measurable down trend in values over the past 30 years.

Sales in 2011 ran the gambit from distressed, to commercial, to trophy quality properties. Trophy vineyard, winery, and residential estates in the heart of the Napa Valley continue to sell at unprecedented prices. Commercial vineyards in Prime and Secondary areas also saw strong demand with the highest prices paid for established properties with the right varieties and positive earnings. Industry experts feel this momentum, coupled with increasing signs of economic recovery and improving wine sales, should generate continued market improvement in 2012. From the trends which occurred in 2011, the forecast is that 2012 numbers will exceed 2011 in the number of transactions, and at higher price points.

Key factors driving the market start with two short grape crops and limited inventory in the pipeline, coupled with an improving economic outlook and improving wine sales. These facts justifiably fan concerns of an impending grape shortage, with most industry experts anticipating higher grape costs in 2012. Taking a line from Mr. Tony Correia’s “Grape Wheel”, we see that increasing grape demand is driving grape prices higher, which in turn is putting upward pressure on land and vineyard values. As a result, market demand and values should remain strong throughout the region. Demand for commercial vineyards regardless of being in the prime, secondary, or fringe areas should improve assuming these properties can generate positive returns. Simple economics are at play in most markets, with profitability being a key driver for both buyers and lenders involved in these transactions. As discussed above, Napa County is a diverse market that covers a broad range of values. To limit confusion when speaking to value ranges it is best to segment the market as follows:

PRIME REGION: This includes the heart of the Napa Valley (St. Helena, Rutherford, Oakville) and surrounding hillsides (Prichard Hill, Howell Mountain, Stags Leap, and Spring Mountain). This region has experienced stable growth and demand over the past 30 years. While there are limited properties for sale, market activity has been good. Several trophy properties have sold at prices well above the average range noted in the following table, with evidence that there are a number of very wealthy industry, foreign, and lifestyle buyers with very deep pocketbooks actively looking for properties today.

SECONDARY REGIONS: These regions are within the Napa Valley and bracket the Prime Region to the north and south, including Calistoga, Yountville, Oak Knoll, Napa and Carneros. There have been a number of vineyard and winery transactions within this market that generally support good price stability.

FRINGE AREAS These areas include Pope and Chiles Valley, and possibly American Canyon (Fringe or Secondary). These regions are outside of the Napa Valley and traditionally support values that are bracketed by Sonoma and Mendocino County. Several transactions were discovered within these areas, mostly of distressed properties, at what is assumed below typical market prices. Good properties within these areas have not dropped listing prices and should anticipate strengthening market demand as grape demand improves.

Napa County Values

Prime Area Vineyards

$225,000 to >$300,000/acre

Secondary Area Vineyards

$90,000 to $165,000/acre

Fringe Area Vineyards

$35,000 to $75,000/acre

Plantable Land (countywide)

$25,000 to $175,000/acre

Site Contribution (countywide)

$0 to >$3,500,000/site

Sonoma County

In 2011 we experienced a stable to a slightly improving market for Sonoma County commercial vineyard and vineyard estate properties. Buyers ranged from vineyard investment groups, wineries and local growers, to the non-farm and “non-local” professional, executive or business owner. While most of the sales were cash, there was an increase in financing either to complete the sale or reimburse the buyer’s cash reserves. The amount of financing seen in the market was higher than in 2010, which mostly included cash sales.There was a greater disparity in values in 2011 than in prior years. World-class estate properties located in the hills near Sonoma and “boutique” style vineyard properties with sandy soils in the Russian River Valley near Sebastopol sold at a premium. The proximity of Sonoma and the Bay Area coupled with expansive views and privacy create strong demand for Sonoma estates. The ability to develop or purchase a Pinot Noir vineyard producing a luxury to cult quality wine is the driving factor influencing the Sebastopol area.

There was a greater disparity in values in 2011 than in prior years. World-class estate properties located in the hills near Sonoma and “boutique” style vineyard properties with sandy soils in the Russian River Valley near Sebastopol sold at a premium. The proximity of Sonoma and the Bay Area coupled with expansive views and privacy create strong demand for Sonoma estates. The ability to develop or purchase a Pinot Noir vineyard producing a luxury to cult quality wine is the driving factor influencing the Sebastopol area.

Values for good quality vineyards in good areas with the proven ability to generate net earnings of about $4,000 or more per acre remained stable. Values of vineyards with below average earnings softened. In a few instances mid-life vineyards reflecting good management, but limited production, were discounted to near bare land values. Positive earnings are the key to values throughout the market area.

World-class estate homes with construction costs of over $1,000 per square foot have remained stable as long as the finished homes are appropriately designed, landscaped, and well located. These homes contribute near the cost of construction. Stepping down a little, we saw high to very high quality homes contributing 18 to 30% below their depreciated replacement cost, which remains a factor of the economy.

Sonoma County Appellation Map

A few Sonoma County wineries sold in 2011 and a number of wineries were listed for sale. The 2011 winery sales indicate a stable value trend for about the last six years. Sales ranged from small boutique facilities to large 100,000 plus case operations such as Seghesio Winery. Wineries that are being sold without an established brand or with a brand that has been marginally profitable appear to be selling at discounted values. Within the range for Sonoma County, values can be broken down as follows:

Sonoma County Values

Modern Vineyards

$60,000 to $140,000/acre

Open Plantable Land

$32,500 to $75,000/acre

Site Contribution (countywide)

$0 to >$3,100,000/site

* This reflects general market trends throughout Sonoma County, realizing that certain factors could result in prices outside the stated ranges.

* Note most vines on AXR-1 rootstocks are near the end of their economic life and no longer have a significant impact on vineyard and/or plantable land values.

Mendocino & Lake Counties

The most newsworthy event in Mendocino County in 2011 was the Brown Forman sale of Fetzer Winery and Vineyards to “Concha y Toro” for a reported $238 million. While this sale has not had any apparent impact on the rest of the market, 2011 saw some improvement in the wine grape markets. This is very good news following a difficult 2008 season, due to the significant frost damage and smoke taint from area fires, and very low commodity prices in both 2009 and 2010

Given the short 2011 crop throughout most of the North Coast, wineries returned to Mendocino and Lake Counties to buy grapes. The increased demand by wineries enabled growers to contract their fruit at reasonable prices. However getting the grapes to the winery was a major undertaking. The late harvest, heavy rains and limited labor force made for what many growers called the “Harvest from Hell.” Most growers had to fight bunch rot, low sugar levels and muddy fields. While most growers were able to harvest their crop, the yields were down and some wineries discounted the price for low sugar and quality issues.

Pinot Noir in Mendocino County, especially from the Anderson Valley, saw good demand in 2011. While many growers received prices over $3,500 per ton in Anderson Valley, prices in the inland valleys were typically below $1,500 per ton. The demand for Cabernet Sauvignon was exceptionally strong at $1,300 to $1,600 per ton throughout most of the region. The spot market price of Chardonnay and Merlot was nearly double the 2010 levels at $900 to $1,200 per ton. While commodity prices increased considerably in 2011, the crop size was below average, resulting in only modest returns for most growers but higher expectations for a profitable 2012 harvest.

The · sales activity in Mendocino County in the past year has been limited to only a few small vineyards around Ukiah, plus a couple vineyards in Anderson Valley.

Anderson Valley vineyards appear to be holding their value or increasing, given the continued demand from Napa and Sonoma County wineries. Conversely, the Ukiah area sales show a continued downward trend in values. Given the limited demand for vineyard properties, only the well priced properties have sold. The number of vineyard listings in Mendocino County is at an all-time high, with ranches ranging from 10 to over 200 acres available throughout the region.

The sales activity in Lake County was dominated by bank-owned properties. While most of these 2011 sales were marginal vineyards, prices were generally less than $5,000 per acre. These bank-owned transactions forced prices and values for average quality vineyards to below $12,000 per acre. Effectively no good quality vineyards have sold in the past few years. Additionally, the sales activity for plantable land in Lake County is non-existent primarily since the market is below the cost of development.

Mendocino County Appellation Map

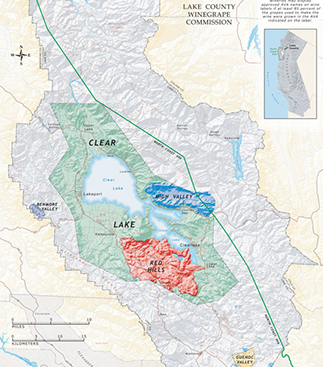

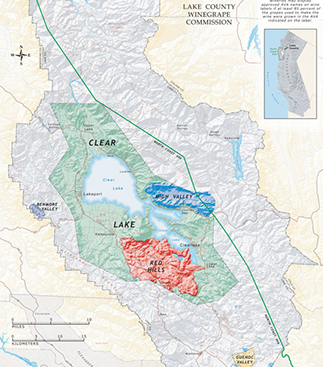

Lake County Appellation Map

Mendocino County Values

Vineyards: Resistant Rootstock

$14,000 – $75,000

Vineyards: AXR

$8,000 – $20,000

Open Land (or Pears)

$7,000 – $20,000

Lake County Values

Vineyards: Resistant Rootstock

$10,000 – $22,000

Vineyards: AXR

$4,000 – $8,000

Open Land (or Pears)

$3,500 – $7,000

HISTORICAL VALUE RANGE (Per Acre)

Napa County

2011

$35,000 – $300,000

$25,000 – $175,000

$0 – $3,500,000

2010

$50,000 – $300,000

$30,000 – $175,000

$0 – $3,500,000

2009

$55,000 – $300,000

$35,000 – $175,000

$200,000 – $3,500,000

2008

$55,000 – $300,000

$35,000 – $175,000

$200,000 – $3,500,000

2007

$55,000 – $285,000

$35,000 – $160,000

$200,000 – $3,500,000

2006

$50,000 – $275,000

$30,000 – $160,000

$0 – $3,500,000

5005

$55,000 – $200,000

$30,000 – $145,000

$0 – $3,500,000

Sonoma County

2011

$60,000 – $140,000

$35,500 – $75,000

$32,500 – $75,000

$0 – $3,100,000

2010

$60,000 – $125,000

40,000 – $55,000

$35,000 – $55,000

$0 – $3,100,000

2009

$60,000- $100,000

$40,000 – $50,000

$34,300 – $50,000

$0 – $2,600,000

2008

$70,000 – $125,000

$45,000 – $80,000

$35,000 – $80,000

$0 – $3,000,000

2007

$70,000 – $125,000

$45,000 – $60,000

$35,000 – $60,000

$0 – $3,000,000

2006

$65,000 – $85,000

$45,000- $60,000

$40,000 – $50,000

$0 – $2,500,000

2005

65,000 – $85,000

$45,000 – $58,000

$37,500 – $45,000

$0 – $2,500,000

Mendocino County

2011

$14,000 – $75,000

$8,000 – $20,000

$7,000 – $20,000

2010

$20,000 – $55,000

$8,000 – $20,000

$7,000 – $20,000

2009

20,000 – $60,000

$10,000 – $20,000

$8,000 – $23,000

2008

$28,000 – $75,000

$15,000 – $35,000

$10,000 – $35,000

2007

$28,000 – $60,000

$15,000 – $30,000

$10,000 – $25 ,000

2006

$28,000 – $55,000

$15,000 – $25,000

$11 ,000 – $24,000

2005

$28,000- $45,000

$15,000 – $25,000

$10,000 – $20,000

Mendocino County

2011

$10,000- $22,000

$4,000 – $8,000

$3,500 – $7,000

2010

$15,000 – $25,000

$5,000 – $10,000

$4,000 – $8,000

2009

$15,000 – $30,000

$6,000 – $18,000

$5,000 – $10,000

2008

$20,000 – $45,000

$10,000 – $18,000

$6,000 – $12,000

2007

$22,000 – $35,000

$10,000 – $18,000

$6,000 – $11,000

2006

$24,000 – $35,000

$10,000 – $18,000

$6,000 – $12,000

2005

$24,000- $35,000

$10,000 – $18,000

$6,000 – $10,000

Download Here

Next Newsletter

Previous Newsletter

Some additional articles that might be helpful:

What is a vineyard really worth? It depends.

Wine Country Real Estate Building Blocks

Looking to Buy A Winery, Start Here

So where exactly is wine country?

Which AVA came first?

If you are serious about your wine country search, please contact us today. Last but least, here is link to more local resources.