As we plow headlong into the heat of summer, fortune continues to shine on wine country. The real estate market continues to simmer. It looks as if there is another solid crop hanging on the vine and grape prices are still very favorable. With the late winter rains and a mild frost season behind us we can look ahead with hopes of managing through the rest of the dry season and capping off the notable drought with the beginning of an El Nino weather event. Beyond that, demand for premium wines continues to increase as does the desire to be a part of wine country.

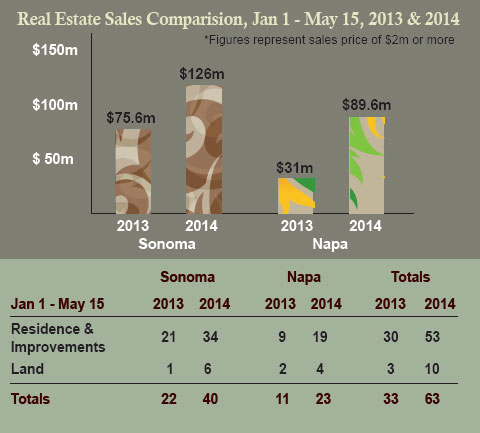

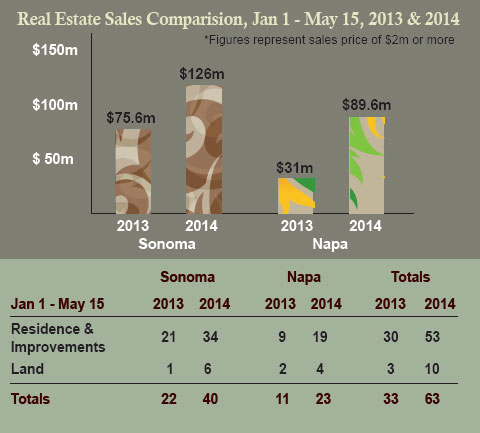

Sales of wine country real estate properties are brisk and the volume is up substantially from last year at this time, especially in the $2 million or more category. The volume of sales has almost doubled and the overall value is nearly as robust. Inventory has improved somewhat of late with a few sellers pushing the boundaries and looking to set new records. But, we still need more inventory.

Lifestyle Buyers and Wineries as Buyers, Same But Different

Lifestyle buyers are out in force looking for a beautiful setting, a quality vineyard, and anything from a charming home to an architectural masterpiece. They’re even looking for land to build on. Here’s a hint, when land starts moving again as it did within the last year, that’s when you know the market has really turned the corner. That means a buyer is willing to allocate resources for the real estate purchase, spend the money and time on infrastructure, architects, contractors, and wait for the final product. Even so, most lifestyle buyers are looking for something more turnkey.

Wineries are still buyers, looking for vineyards and other winery / brand acquisitions to add to their portfolios and distribution channels. Depending on the buyer profile, some wineries are looking to purchase vineyards that don’t have long-term contracts; they want to use the fruit. Others are fine with contracts as long as they are favorable. Another trend involves wineries replanting older / underutilized vineyards forbetter production through tighter spacing, disease resistant rootstock, and modern farming techniques. Wineries continue to see a long-term trend towards a balanced yet tight premium wine grape market down the line. This is good news for growers.

Key Points For Winery Buyers and Sellers

Here are a few key points for winery buyers and sellers. Most serious winery buyers tend to have a longer time horizon when looking at an ROI for this kind of investment. They’re not looking at the next quarter per se; rather they have a long view perspective and appreciate the uniqueness of a particular location, pedigree, and the value of the real estate asset that will provide substantial gains over time. There is another way to value a winery beyond real estate assets, improvements and inventory. If a winery owner has a profitable business, one can look at the valuation using a multiple of 8x – 12x EBITDA depending on the size, brand recognition, and sales momentum of the business. Ultimately, the value depends on all of the factors mentioned above.

The Price Is Right!

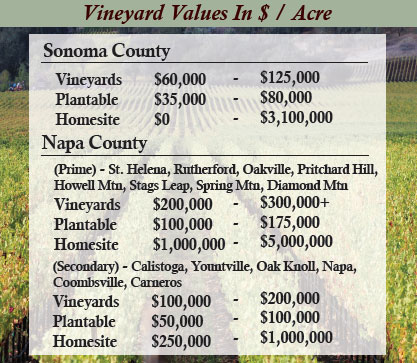

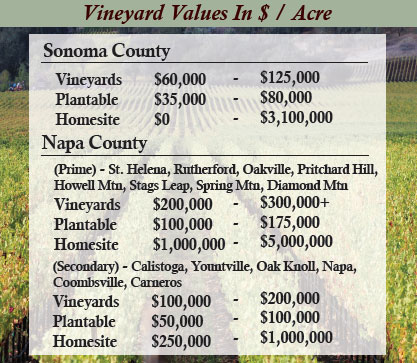

Vineyard prices remain strong as the lifestyle player and winery buyer are actively involved in the market. Prices range anywhere from $60k / acre for an older AXR1 vineyard that needs to be replanted in Sonoma County to upwards of $500k / acre for an extremely high end Oakville / Rutherford Cabernet vineyard that is part of a luxury estate sale with a hobby vineyard. The averages are tempered more than the extremes just noted. In Sonoma County you will find most vineyards ranging from $75k / acre up to and beyond $125k / acre for a Russian River Pinot Noir vineyard. In Napa you will find vineyards typically ranging from $100k+ in Carneros to $300k+ in Oakville and Rutherford Appellations.

A rather new phenomenon has begun among certain lenders regarding site specific values. Generally speaking, lenders assign a value to a property based on a number of criteria including the location / appellation. Each appellation has a relative value associated with it. Now, lenders are looking beyond the appellation barrier to the actual site to determine if there is more value than the associated appellation may suggest. For instance, if a vineyard has a history of producing premium wine grapes and receiving premium grape prices due to a special combination of soils or micro climate that differs from its associated appellation, then it should have a higher value.

We have long known that there are always exceptions to the rule, especially in farming, terroir and appellations. It is nice to see that some lenders are open to that concept as well. Fortune continues to shine on wine country with this new and logical approach.

Growing Season

2014 is shaping up to be an interesting season with what looks to be another healthy crop on the vine. While it is still early in the game with at least several more months to go, things do look promising. This would be the third large harvest in a row, something unheard of in wine country. Usually after a large harvest, let alone two large harvests, vineyards take a breather but not so this year. With another large / average harvest on the vine, we’re looking at limited tank space which could put some downward pressure on grape prices, moderating the trend of the last two years. High end Cabernet and other varietals will still demand a premium.

A long-term view for the premium wine grape market still suggests a balanced – tight market that would support prices and provide an increase over time. To put things in perspective, there’s been a 14% increase in production from 2005 – 2013 in California. In 2005, 3.7 million tons were harvested compared to 4.2 million tons in 2013.

Import & Export

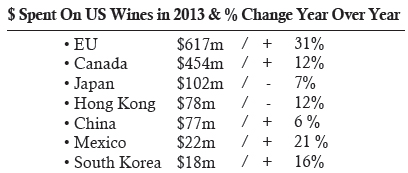

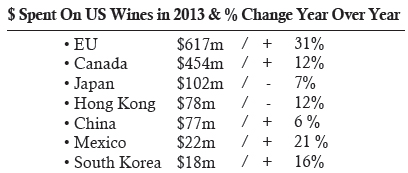

All this talk about big crops, increasing demand, and premium wine makes me wonder where it all goes… aside from my glass! California is responsible for almost 90% of all US wine exports. In 2013 winery export revenue reached $1.55 billion, an increase of more than 16% from 2012 and the fourth year in a row of gains. Here’s a quick breakdown of our biggest fans across the globe in dollars spent and % change from the previous year.

A Look Abroad

Not only does the world love our wine but they also know a stable country and investment when they see one. Let’s take a look at the top 10 countries interested in investing in US real estate according to USA Today. The following list shows the percentage of change in interest in investing in the US from 2009 – 2013. Fortune continues to shine on wine country with help from these investments.

Top 10 Countries Interested In Investing In The United States

1. United Arab Emirates

> Growth in prospective homebuyers: 352.2%

> Share of int’l prospective buyers: 1.1% (12th highest)

> Ultra high net worth population: 1,050 (26th highest)

2. Switzerland

> Growth in prospective homebuyers: 269.7%

> Share of int’l prospective buyers: 2.1% (8th highest)

> Ultra high net worth population: 6,330 (7th highest)

3. Hong Kong and China

> Growth in prospective homebuyers: 254.2%

> Share of int’l prospective buyers: 4.1% (4th highest)

> Ultra high net worth population: 13,855 (4th highest)

4. France

> Growth in prospective homebuyers: 190.0%

> Share of int’l prospective buyers: 2.8% (6th highest)

> Ultra high net worth population: 4,490 (9th highest)

5. Italy

> Growth in prospective homebuyers: 178.4%

> Share of int’l prospective buyers: 1.9% (10th highest)

> Ultra high net worth population: 2,075 (14th highest)

6. United Kingdom

> Growth in prospective homebuyers: 153.8%

> Share of int’l prospective buyers: 12.1% (2nd highest)

> Ultra high net worth population: 10,910 (4th highest)

7. Australia

> Growth in prospective homebuyers: 121.9%

> Share of int’l prospective buyers: 11.0% (3rd highest)

> Ultra high net worth population: 3,405 (11th highest)

8. Canada

> Growth in prospective homebuyers: 107.7%

> Share of int’l prospective buyers: 45.0% (the highest)

> Ultra high net worth population: 4,980 (8th highest)

9. Sweden

> Growth in prospective homebuyers: 100.0%

> Share of int’l prospective buyers: 2.0% (9th highest)

> Ultra high net worth population: 1,070 (25th highest)

10. Germany

> Growth in prospective homebuyers: 95.2%

> Share of int’l prospective buyers: 2.6% (7th highest)

> Ultra high net worth population: 17,820 (2nd highest)

Drought & El Nino

Just like the wet winters and dry summers, Northern California offers many extremes. Whether it is the rugged beautiful coast, rolling inland hills or towering Sierra Nevada, our part of the world offers something for everyone. The typical weather cycles also seem to follow that pattern. We are moving through one of the more severe droughts on record and were fortunate to receive late season rains that filled some reservoirs and provided much needed relief. Even so, there are growers and farmers that are in need in of resources where restrictions are in place. Our thoughts are with them throughout the rest of the season.

There may be a reason for hope on the horizon that comes in the form of the weather pattern known as El Nino. An El Nino weather pattern typically leads to a wetter than normal winter in California which is much needed at this point. Early indications of an El Nino include warming waters and a more active hurricane season in the Pacific Ocean. Considering we just had one of the most powerful early season hurricanes off Baja in recorded history, things are looking positive for a wet winter. With that in mind, clean out your gutters!

Quick Facts

• Wineries Looking To Refinance? – Contact me to discuss the opportunity to use crowdfunding resources to refinance and infuse cash into your business.

- Oak Knoll Appellation Celebrates 10 Years In The Napa Valley

- Petaluma Gap Association Looks To Create the Petaluma Gap Appellation

- Wine Museum Set To Open In Santa Rosa in 2015San Francisco Chronicle Report Shows Tradtional Real Estate Marketing Nets 17% More than “Off Market Sales”

- 66% Of All Vineyards In The Napa Valley Are Owned By Wineries, 99% Of The Value Of All Crops In Napa County Is Wine Grapes

Have a Great Summer!

All in all things are looking up for the summer of 2014. The real estate market has recovered from the shattering effects of the great recession. Lifestyle buyers are looking for their wine country estates. Wineries are still buying vineyards. Grape prices are higher than they have been in years. Another solid crop appears to be on the way and it looks like relief from our severe drought is just around the corner. The market can still use more quality inventory of estates, vineyards and wineries. Remember fortune continues to shine on wine country. As always, if you’re interested in selling or would like to know what your property is worth, I would like the opportunity to speak with you. Please don’t hesitate to call (707) 531-7914 or email david@vineyardandwinerysales.com. I look forward to speaking with you soon.

Cheers!

Download PDF Here

Next Newsletter

Previous Newsletter

Some additional articles that might be helpful:

What is a vineyard really worth? It depends.

Wine Country Real Estate Building Blocks

Looking to Buy A Winery, Start Here

So where exactly is wine country?

Buying a Vineyard? A short course to the basics.

Which AVA came first?