Napa, Sonoma, Mendocino, & Lake Counties

ARA (Agricultural Rural Appraiser) Contributors:

An Excerpt from the 2013 Trends

– Hal Forcey ARA, Chair

– Mark Gregg ARA

– Russ Forsburg ARA

– Michael D Pipkin ARA

Napa County

2012 hit a milestone for the US wine industry, as the USA overtook France and Italy to become the largest wine consuming country in the world. While Napa is the most recognized wine region in California, we must understand that we are part of an international marketplace. A benefit of being part of the international market is knowing that Napa wines and real estate are held in high esteem within this global marketplace.

The 2012 market for Napa County saw a continuation of the upward trend which started in 2011. While the 2011 market was fueled by a strong Chinese presence in the first half of the year, the predominant buyer emerging in the second half of 2011 and continuing throughout 2012 were local buyers. This is a very key consideration, since history indicates that markets dominated by local buyers are typically markets in recovery. 2012 was also a banner year relative to the number of properties sold, with growers and wineries actively expanding their vineyard and winery holdings. Also, the lifestyle-buyer, who had been absent for several years, was back in the market, snapping up a record number up trophy vineyard and estate sites at unprecedented prices.

With few distressed sales observed in 2012, Napa County continued its

historic upward price trend. Real estate prices for Prime Napa Valley locations generally moved upward in 2012. Market demand was a little softer, with stable to increasing prices also reported in the Secondary Napa Valley locations. Sales activity in the outlying areas (outside the Napa Valley) were virtually nonexistent in 2012, but indications show that these markets are stable to improving, with many parcels pulled off the market as property owners forecast significantly higher earnings.

The fact that US wine consumption continues to improve, coupled with the quality of the 2012 harvest, positions 2013 to be a very good year. While improvement in the premium wine markets is slow, winery

optimism remains strong. Although the economy is a bit nervous, it is

improving, with both real estate and the wine industry seen as good investment opportunities. Access to financing also appears to be easing, and while traditional lenders continue to pursue sound credits, we are seeing growing interest from specialty lenders, with the biggest competition coming from the Cash Buyer. Many of the buyers competing in the market are not overleveraged and are focused on long term earnings potential from wine grapes and wine. While they may wish to use leverage, many have

cash, and lenders often have to compete with this.

Factors driving Napa’s diverse markets focus primarily on the quality and reputation of the area, coupled with growing scarcity of available vineyards, wineries, plantable land, and trophy estates in the region. Local buyers are aware that Napais virtually out of additional plantable land. They also understand that local and governmental barriers have significantly curtailed the probability of developing significantly more undeveloped land in the area. As a result, they are actively buying existing properties before prices really start to escalate, which is a classic “Supply & Demand” valuation model.

Although 2012 was the largest crop in Napa’s history, wineries were able to fully utilize the harvest and replenish inventories depleted by several short crops. Even though the premium pipeline is comfortably full, grape supply is a major concern for 2013, with most wineries concerned that there are not enough grapes to keep up with growing demand. Moving forward, wineries will continue to secure long term grape contracts, and actively look for vineyards and plantable land. For 2013, market demand and values should remain strong throughout the region, with grape prices, plantable land and vineyard values trending higher. Key drivers for the market will continue to

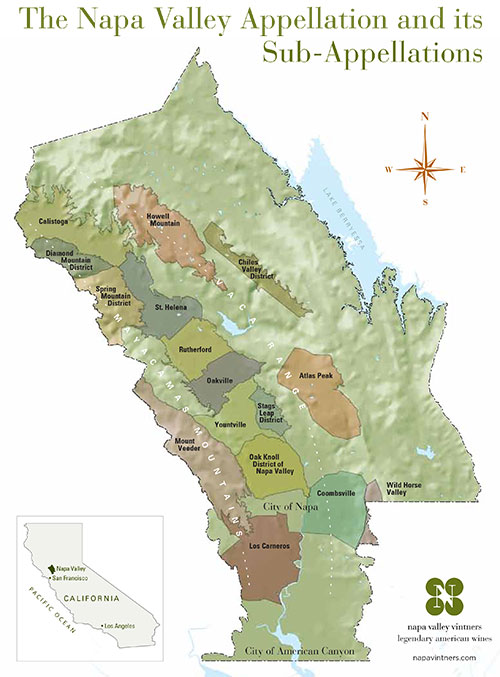

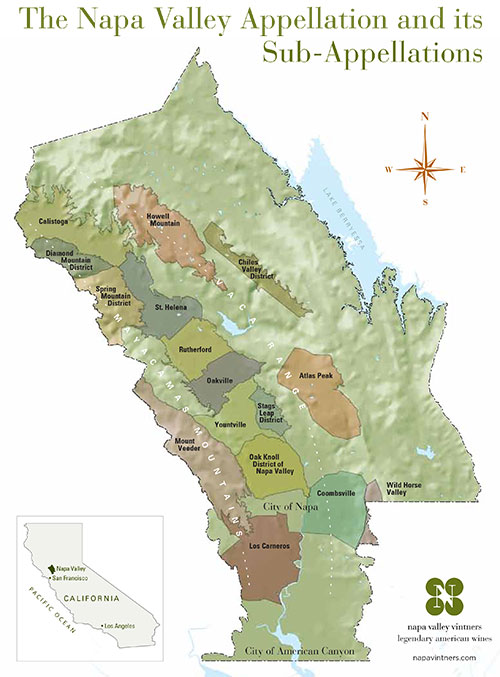

Napa Valley Appellations

focus on location and fruit quality, as well as vineyard economics and profitability.

Napa is a diverse market with vineyards ranging from $50,000 to over $300,000 per acre. Values are heavily influenced by location, but more importantly by the terroir, which drives the variety potential and fruit quality of a specific site or location. Considering both location and terroir, we see vineyard values generally falling into three distinct categories. We have chosen to identify these as Prime, Secondary, and Outlying, realizing that the stated value ranges are simply guidelines and those values overlap between the noted

locations and/or categories:

PRIME REGION includes the heart of the Napa Valley (St. Helena, Rutherford, and Oakville) and the surrounding hillsides (Pritchard Hill, Howell Mountain, Stags Leap, and Spring Mountain). Terroir allowing the production of premium Cabernet Sauvignon, which is the Hallmark of the Napa wine industry, drives this category. Sites not suitable for premium Cabernet production generally fall into the Secondary value category. Additionally, here are properties outside this geographic region, capable of premium Cabernet production that command Prime area values. This category has experienced stable growth and demand over the past 30 years. 2012 market activity was good with a number of vineyard, winery, and trophy estate sales. 2013 should be strong, as there are a number of industry, foreign, and lifestyle buyers with deep pockets actively looking for properties in this region or category.

SECONDARY REGIONS includes properties that bracket the Prime region to the north (Calistoga) and to the south (Yountville, Oak Knoll, Napa, and Carneros). The terroir in these areas are best suited to Chardonnay, Pinot Noir, Sauvignon Blanc, Merlot, Zinfandel, etc. As these varieties generally produce lower per acre returns, market values decline accordingly. It is important to note that this category includes sites in the heart of the Napa Valley that are best suited to white wine grape production. There have been a number of vineyard transactions in this market segment over the past two years that support general price stability.

OUTLYING NAPA COUNTY generally includes the remaining growing regions located outside the Napa Valley, including American Canyon, Pope Valley, Chiles Valley, and outlying areas. While these areas produce high quality fruit, they are subject to more extreme weather patterns that increase productive risk and reduce long term/historic earnings. This reduces economic returns and holds values down. There have been few transactions over the past two years, but economic returns improved significantly in 2012, suggesting values will continue to trend higher.

Napa County Values

Prime Area Vineyards

$200,000 to > $300,000 / acre

Prime Area Plantable

$100,000 t0 > $165,000 / acre

Prime Area Homesite

$1,000,000 to > $5,000,000

Secondary Area Vineyards

$100,000 to > $200,000/acre

Secondary Area Plantable

$50,000 to > $100,000 / acre

Secondary Area Homesite

$250,000 to > $1,000,000

Outlying Area Vineyards

$50,000 to > $100,000 /acre

Outlying Area Plantable

$25,000 to > $50,000 / acre

Outlying Area Homesite

$0 to > $350,000

*The chart reflects general market trends throughout Napa County, realizing that certain factors could result in prices outside the stated ranges.

Sonoma County

2012 saw stable to increasing markets for commercial vineyard and vineyard estate properties with an unprecedented number of sales in all categories. This trend was a factor of two years of short crops, a shortage of bulk wine and grapes for sale, and increasing demand for wine, coupled with slow economic recovery. These factors resulted in increasing grape prices and, along with historically low interest rates, spurred wineries to purchase vineyards and plantable land in order to secure future throughput and greater control of their grape costs. In some instances, it was a factor of controlling a vineyard designated for a specific wine brand.

The wineries purchasing vineyards and plantable land were mostly locally based. The buyer base included such entities as Jackson Family Wines, Foley Family Wines, Duckhorn Vineyards, and Classic Wines. Local growers, vineyard investment groups, and Native Indian Tribes with casino interests also purchased properties. Similarly, wineries were willing to provide long term grape or development contracts at viable prices.

Purchases were generally viticultural area and/or vineyard designation driven. For example, interest for Alexander Valley Cabernet Sauvignon and Russian River Valley Pinot Noir was particularly strong. This statement is tempered by the fact that even within a single viticultural area there can be a wide range in value, due to grape quality, as a result of soils and micro-climate.

Vineyard viability remained highly scrutinized with marginal vineyards being discounted in value. Vineyards with net earnings of a couple thousand dollars above hard farming costs have been purchased at prices near bare land values. Even lifestyle vineyards are expected to provide a return over farming cost. Values for good quality vineyards in good areas with the proven ability to generate net earnings of about $4,000 or more per acre were stable to increasing. The increasing value trend is not a factor of record prices being

paid but rather a movement of vineyard and plantable land values toward the upper end of the 2011 value range. For instance, a vineyard that was $65,000 to $75,000 per acre is now in the range of $70,000 to $80,000 per acre. The high vineyard value of $140,000 per acre in 2011 was reduced to $125,000 per acre for 2012 to reflect a more typical allocation, rather than a value for very small and unique vineyards.

The “non-farm” and “non-local” professional, executive, or business owners remain theprinciple players for those properties that provide a “lifestyle” element such as private viewsites in desirable locations. The lifestyle

Sonoma County Appellation Map

properties have not rebounded to the same extent as the commercial vineyard market as existing estate homes can still be purchased for less than current construction cost or less normal physical deprecation. There are a few “world class” properties that have been offered for sale in the $30,000,000 and over category, but these properties have not moved.

An increasing number of Sonoma County wineries sold in 2012 with a few wineries still listed for sale. The 2012 winery sales indicate a stable value trend for about the last seven years. Sales ranged from small boutique style facilities to large 50,000+ case facilities. Wineries that are being sold without an established brand or with a brand that has been marginally profitable are selling at discounted values. The Sonoma-Marin agricultural area is typically described as the coastal foothill pasture and hardwood forested lands within Southwestern Sonoma County and Northwestern Marin County. Most of the

area is devoted to agricultural uses of livestock pasture, dairies, and, on a limited basis, equestrian facilities, poultry facilities, and specialty vegetable production. Average through estate quality homes are also positioned throughout the area. The residential attraction is attributed to the diverse foothill settings, proximity to San Francisco, and mild coastal climate.

Grade A dairies producing conventional and organic milk tend to be the dominant commercial use of the area. The decline in conventional milk prices and high feed costs resulted in a number of conventional producers going out of business or transitioning their herds and facilities to organic milk. Organic dairies have established a niche due to higher organic milk prices, availability to pasture cows, and the area’s proximity to the Bay Area consumermarket.

Land values in the last four years have declined about 16% to as much as 30% due to the national recession. In the last six months, market activity has increased with local dairymen and Bay Area residents being the principal buyers. Successful dairymen are purchasing property for organic native pasture. The estate buyer tends to be interested in properties that are suited for second homes.

Conservation organizations are active in the area. These entities purchase property development rights entitlements limiting future residential development. For local dairymen and livestock producers, the sale of development rights has provided cash infusions to their operations.

Sonoma County Values

Modern Vineyards

$60,000 to $125,000/acre

Open Plantable Land

$35,000 to $80,000/acre

Site Contribution (countywide)

$0 to >$3,100,000/site

* This reflects general market trends throughout Sonoma County, realizing that certain factors could result in prices outside the stated ranges.

Mendocino & Lake Counties

Mendocino County has two distinct markets including the coastal Anderson

Valley, renowned for high quality Pinot Noir, and Inland Mendocino, which

produces a wide variety of premium wine grapes. Given the short 2011 crop throughout most of the North Coast, wineries returned to Mendocino and Lake Counties to buy grapes. The increased demand enabled growers to contract their fruit at good prices in 2012. The yields for most growers were average to slightly above historical averages. The two varieties that experienced below average production were Sauvignon Blanc and Cabernet Sauvignon. While 2011 was called the “Harvest from Hell”, the 2012 harvest was actually a normal typical crop year.

The fruit quality was exceptional in 2012, but the compact nature of the harvest made deliveries difficult. Some growers were forced to deliver grapes in November due to the lack of storage space at the wineries. Anderson Valley saw continued strong demand for Pinot Noir in 2012, with many growers receiving prices over $3,500 per ton, while Inland Mendocino Pinot Noir was closer to $1,500 per ton. The demand for Cabernet Sauvignon was exceptionally strong at $1,500 to over $1,800 per ton throughout most of the region. The market price of Chardonnay and Merlot remainedgood at $1,000 to $1,400 per ton.

The sales activity throughout Mendocino County in the past year has been modest with a mixture of small and large vineyard sales around Ukiah, plus a couple vineyard sales in Anderson Valley. Anderson Valley vineyards appear to be stable to slightly increasing, given the continued demand from Napa and Sonoma County wineries. Inland Mendocino County sales show that stability has returned to the market. The number of vineyard listings in Mendocino County has returned to more historic levels, given the recent sales and some sellers taking their properties off the market as they now anticipate being able to farm their vineyards at a profit.

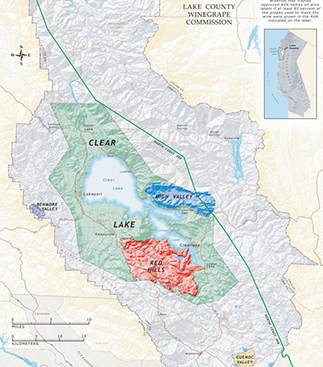

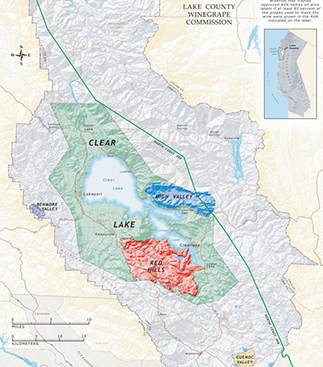

While the 2011 sales activity in Lake County was dominated by bank-owned properties, several good quality vineyards sold in 2012 at strong prices. Most of the good vineyard properties sold in the range of $20,000 to $35,000 per acre, while average to fair quality Lake County vineyards dropped all the way down to $15,000 per acre. The highest price vineyards were located in the Red Hills and High Valley regions of the county. The sales activity for plantable land in Lake County was virtually non-existent, with no new developments occurring in the county. Two notable headline sales occurred in 2012, including Snows Lake (Gallo) and Guenoc (Foley, Lake & Outlying Napa County). While we have not yet been able to confirm these sales, they reflect that industry leaders are actively searching for premium vineyards and plantable land in areas that have not been given serious consideration for

many years.

Mendocino County Appellation Map

Lake County Appellation Map

Mendocino County Values

Anderson Valley Vineyards

$65,000 to $85,000/acre

Anderson Valley Plantable Land

$25,000 to $35,000/acre

Inland Mendocino Vineyards

$15,000 to $30,000/acre

Inland Mendocino Plantable Land

$7,500 to $10,000/acre

Site Contribution (county wide)

$50,000 to $250,000/site

Lake County Values

Vineyards: Resistant Rootstock

$15,000 – $35,000

Open Land (or Pears)

$4,000 – $8,500

HISTORICAL VALUE RANGE (Per Acre)

Napa County

2012

$50,000 – $300,000

$25,000 – $150,000

$250 – $5,000,000

2011

$35,000 – $300,000

$25,000 – $175,000

$0 – $3,500,000

2010

$50,000 – $300,000

$30,000 – $175,000

$0 – $3,500,000

2009

$55,000 – $300,000

$35,000 – $175,000

$200,000 – $3,500,000

2008

$55,000 – $300,000

$35,000 – $175,000

$200,000 – $3,500,000

2007

$55,000 – $285,000

$35,000 – $160,000

$200,000 – $3,500,000

2006

$50,000 – $275,000

$30,000 – $160,000

$0 – $3,500,000

2005

$55,000 – $200,000

$30,000 – $145,000

$0 – $3,500,000

Sonoma County

2012

$60,000 – $125,000

$35,000 – $80-,000

$0 – $3,100,000

2011

$60,000 – $140,000

$35,500 – $75,000

$32,500 – $75,000

$0 – $3,100,000

2010

$60,000 – $125,000

40,000 – $55,000

$35,000 – $55,000

$0 – $3,100,000

2009

$60,000- $100,000

$40,000 – $50,000

$34,300 – $50,000

$0 – $2,600,000

2008

$70,000 – $125,000

$45,000 – $80,000

$35,000 – $80,000

$0 – $3,000,000

2007

$70,000 – $125,000

$45,000 – $60,000

$35,000 – $60,000

$0 – $3,000,000

2006

$65,000 – $85,000

$45,000- $60,000

$40,000 – $50,000

$0 – $2,500,000

2005

65,000 – $85,000

$45,000 – $58,000

$37,500 – $45,000

$0 – $2,500,000

Mendocino County

2012

$15,000 – $85,000

$7,500 – $35,000

2011

$14,000 – $75,000

$8,000 – $20,000

$7,000 – $20,000

2010

$20,000 – $55,000

$8,000 – $20,000

$7,000 – $20,000

2009

20,000 – $60,000

$10,000 – $20,000

$8,000 – $23,000

2008

$28,000 – $75,000

$15,000 – $35,000

$10,000 – $35,000

2007

$28,000 – $60,000

$15,000 – $30,000

$10,000 – $25 ,000

2006

$28,000 – $55,000

$15,000 – $25,000

$11 ,000 – $24,000

2005

$28,000- $45,000

$15,000 – $25,000

$10,000 – $20,000

Lake County

2012

$15,000- $35,000

$4,000 – $8,500

2011

$10,000- $22,000

$4,000 – $8,000

$3,500 – $7,000

2010

$15,000 – $25,000

$5,000 – $10,000

$4,000 – $8,000

2009

$15,000 – $30,000

$6,000 – $18,000

$5,000 – $10,000

2008

$20,000 – $45,000

$10,000 – $18,000

$6,000 – $12,000

2007

$22,000 – $35,000

$10,000 – $18,000

$6,000 – $11,000

2006

$24,000 – $35,000

$10,000 – $18,000

$6,000 – $12,000

2005

$24,000- $35,000

$10,000 – $18,000

$6,000 – $10,000